Forex Trading Basics

The foreign exchange, or forex market, is the world’s largest financial market, and it plays a vital role in the global economy.

Every day, trillions of dollars are exchanged from one currency to another. This kind of currency exchange is essential for international business.

Who participates in Forex ?

Forex market participants include governments, businesses, and of course, investors.

- Governments use the forex market to implement policies.

For example, when conducting business with another country, whether it’s borrowing money, lending money, or offering aid, a country needs to convert its currency into a foreign currency. - Businesses use the forex market to facilitate international trade.

For example, they may need to convert payments for goods and services bought overseas, or to exchange payments from international customers into their preferred currency. - And investors use the forex market to speculate on changes in currency prices.

What happens on the Forex Market?

Currency prices change almost constantly during the week, because the forex market is open continuously from Sunday at 4:00 PM until Friday at 4:00 PM Central Time. A trading day starts at 4:00 PM and ends at 4:00 PM Central Time the following day.

The market has to be open around the clock

because of the global nature of the economy.

How does Forex Work

Let’s go over some basics of how trading forex works.

When you trade forex, you’re not just trading one product, you’re trading two currencies against each other. This is known as a currency pair.

The quote for a forex currency pair defines the value of one currency relative to the other. The easiest way to understand any quote is to read the pair from left to right.

Let’s look at an example of using the euro versus the US dollar currency pair. If the EUR/USD is trading at 1.20, that means 1 euro is equal to 1.20 US dollars.

Here’s another example of using the US dollar versus the Canadian dollar currency pair. If the USD/CAD is trading at 1.25, that means 1 US dollar is equal to 1.25 Canadian dollars.

Even though there are two currencies involved, the pair itself acts like a single entity.

It’s similar to a stock or a commodity. And just like when trading stock, investors profit when they buy a currency pair and its price increases. Investors can also profit if they sell or short a currency pair and the price decreases.

Let’s look at an example

Suppose an investor who thinks Europe’s economy is going to grow faster than the United States, and as a result, she thinks the euro will strengthen against the US dollar. She can buy the euro versus US dollar pair to speculate on her assumption.

If the price of the currency pair rises, she’ll make money. Conversely, if the price falls, she’ll experience a loss.

Other key aspects of Forex

Now that we’ve covered the basics, let’s look at a few key aspects of the forex market.

We’ll start with margin.

When you trade on margin, you only need to put up a percentage of the total investment to enter into a position. This amount is known as the margin requirement. When you trade other securities like stocks, trading on margin means you’re borrowing funds from your broker.

However, forex trades can only be covered using funds in the investor’s forex account. Investors can’t borrow funds to enter a forex trade. If they don’t have funds in their forex account, they need to transfer funds before placing a trade. Forex margin requirements vary depending on the currency pairs and the size of a trade.

Currency pairs typically trade in specific quantities known as lots. The most ecommon lot sizes are standard and mini.

- Standard lots represent 100,000 units,

- and mini lots represent 10,000 units.

- Depending on your brokerage firm, you may also be able to trade forex in 1,000-unit increments, also known as micro lots.

Margin requirements can be as small as 2% of a trade or as large as 20%, but the margin requirement for most currency pairs averages around 3% to 5%.

To understand how margin is calculated, let’s look at an example using the euro versus US dollar pair.

Say this pair was trading at 1.20, and an investor wanted to buy a standard lot or 100,000 units. The total cost of the trade would be $120,000. That’s a lot of capital. However, the investor doesn’t have to pay that full amount. Instead, she pays the margin requirement. Let’s say the margin requirement was 3%. 3% of $120,000 is $3600. That’s the amount the investor needs in her forex account to place this trade. This brings us to another key element of the forex market– leverage.

Leverage enables investors to control a large investment with a relatively small amount of money.

In this example, the investor is able to control $120,000 with $3600. The leverage associated with currency pairs is one of the biggest benefits of the forex market, but it’s also one of the biggest risks. Leverage gives investors the potential to make large profits or large losses.

One more important element in the Forex market is financing

Financing is the calculation of net interest owed or earned on currency pairs, and it happens when an investor holds a position past the close of the trading day. The US dollar is associated with an overnight lending rate set by the Fed, and this rate defines the cost of borrowing money. Similarly, each foreign currency has its own overnight lending rate.

Remember, when you trade a currency pair, you’re trading two currencies against each other. Even though the currency pair acts like the single entity, you’re technically long one currency and short the other. In terms of financing, you’re lending the currency that you’re long and borrowing the currency you’re short. This lending and borrowing occurs the overnight lending rate of each respective currency. In general, an investor receives a credit if the currency he has long had a higher interest rate than the currency he is short. Conversely, an investor is debited if the currency he is long has a lower interest rate than the currency he is short. Let’s look at an example.

Suppose an investor has a position in the Australian dollar versus the US dollar currency pair. Say the overnight lending rate for the Australian dollar is 2% and the overnight lending rate for the US dollar is 1%. The investor is long the currency pair, which means he is long the AUD and short the USD. Since the AUD has a higher interest rate than the USD, the investor will receive a credit. However, if the investor was short the AUD/USD currency pair, he’d have to pay the debit because he’s short the currency that has a higher interest rate. Financing is performed automatically by your brokerage firm. However, it’s important to understand how it works and its financial impact on the trade. We’ve reviewed just a few elements of the forex market.

As with all investment opportunities, the forex market has a unique set of risks and benefits, and education is the first step to determine if this is the right opportunity for you.

Affiliate links

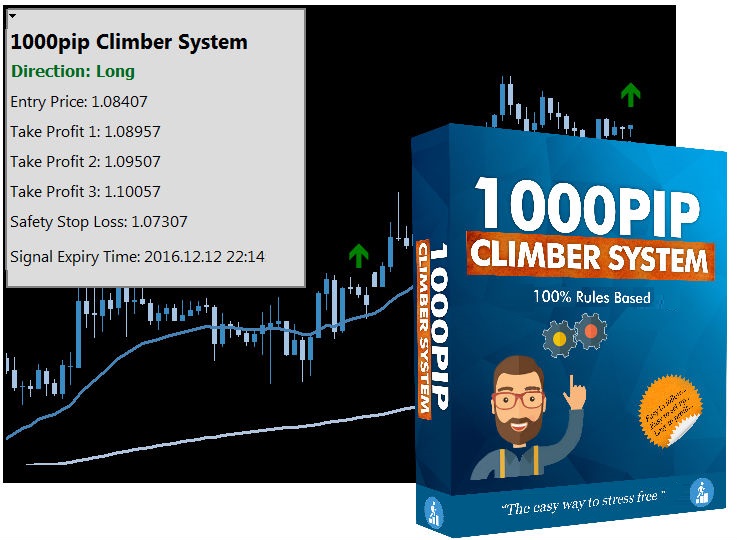

The easy way to follow Forex

Automatic detection with entry, stop loss and take profit values

The 1000pip Climber Forex System is a state of the art algorithm, designed to make it as easy as possible to succeed at Forex. The Forex system continuously analyses the FX market, looking for potentially high probability price movements. Once identified the software will notify you visually, audibly, and via email.

ALL key parameters are provided; entry price, take profit and stop loss. The Forex system is easy to set up and is designed to be followed 100% mechanically – just try the Forex system and see the results. This Forex system really is the simplest way to follow the FX market.

Lifetime license: For only $299 $97 you can have a lifetime licence to use the system. There are NO monthly payments.

Forex signals

Copy Profitable Forex Trades Sent By Expert Trader & Earn Profits For Free

Thank you reading, shares and comment!

Invest in your future & learn

Learn affiliate marketing & build your own website with an awesome community and join me there. You can be a free starter for as long as needed. It includes free hosting and basic teachings. If you are an advanced user, you may like to level up. Just have a look, and see for yourself!