Disclaimer: this article is informative. Always consult with professionals!

Stock market trends for april 2024

In April 2024, the stock market exhibited notable trends and fluctuations. Here’s a detailed analysis of the key developments:

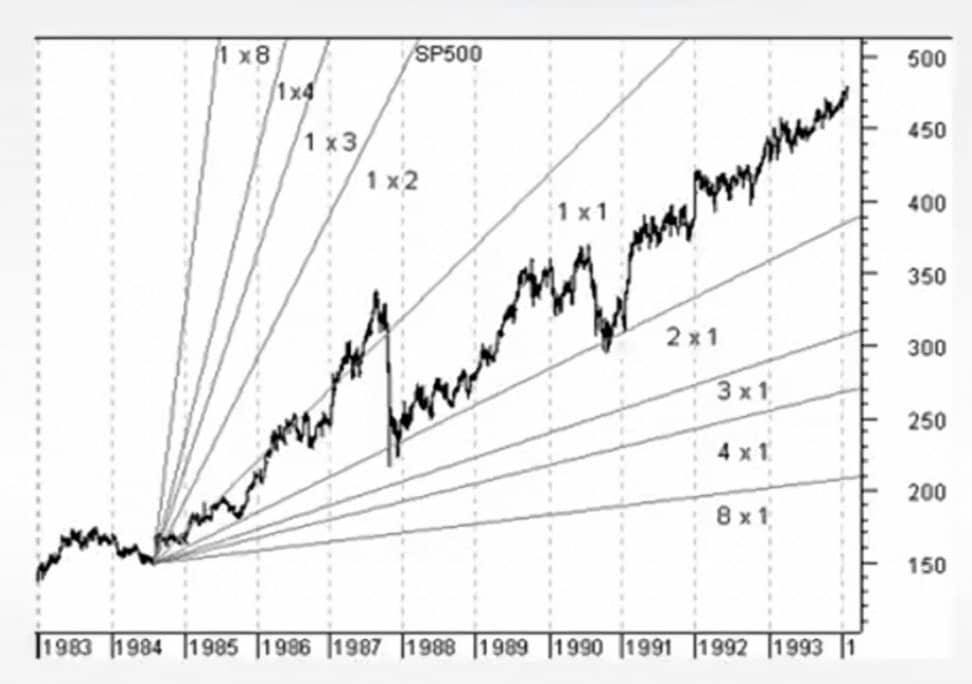

Performance of Major Indices:

- The S&P 500 declined by 4.16% in April, despite a strong start to the year, with a year-to-date (YTD) return of 5.57% (Schwab).

- The Dow Jones Industrial Average fell by 5.00%, with a marginal YTD gain of 0.34% (Schwab).

- The S&P MidCap 400 saw a significant drop of 6.08% in April, bringing its YTD return to 2.86% (Schwab).

Sector Performance:

- Technology stocks, particularly those related to AI and digital innovation, continued to drive market activity. Super Micro Computer (SMCI), an AI server maker, was one of the best-performing stocks in the S&P 500 for Q1 (4X Solutions).

- On the other hand, Tesla (TSLA) struggled, marking a contrast within the tech sector (4X Solutions).

Economic and Geopolitical Influences:

- The Federal Reserve’s monetary policy remained a focal point. The market anticipated potential interest rate cuts later in the year, which could stimulate economic activity and corporate profits (4X Solutions).

- Geopolitical tensions, especially in Eastern Europe, continued to inject uncertainty into the markets, affecting investor sentiment and stock prices (4X Solutions).

Investor Sentiment and Market Dynamics:

- April is historically a strong month for the S&P 500, and optimism was high due to positive economic data and a shift in focus from recession fears to the timing of the Federal Reserve’s policy changes (4X Solutions).

- However, inflation concerns and the Federal Reserve’s ongoing efforts to manage inflation without triggering a recession remained critical to market stability (BlackRock).

Global Economic Outlook:

- In the broader economic context, regions like Europe and emerging markets exhibited mixed signals. The European Central Bank (ECB) and other central banks’ policies significantly influenced market dynamics, as they navigated between inflation control and economic growth (Investment Insights) (BlackRock).

In summary, April 2024 saw significant volatility in the stock market, influenced by a mix of economic data, corporate earnings, geopolitical events, and central bank policies. Investors are advised to remain vigilant and diversified to navigate the evolving market landscape.

Online ressources

For those interested in a deeper look into stock market trends and analyses from April 2024, several reputable sources offer comprehensive insights:

- Morningstar provides a detailed outlook on the U.S. stock market and economy, highlighting factors such as GDP growth projections, labor market performance, and the impact of high interest rates on sectors like commercial real estate. They expect a slowdown in GDP growth and a modest increase in unemployment for 2024 (Morningstar).

- Barron’s covers the performance of major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, noting a significant decline in April due to geopolitical tensions and the onset of earnings season. The article also discusses the broader market reactions to geopolitical developments and their impact on investor sentiment (Barron’s).

- NerdWallet offers insights into AI-powered ETFs and their performance, along with a general market outlook for May 2024. They provide a list of top-performing AI-powered ETFs and discuss the potential benefits and limitations of using AI in investment strategies (NerdWallet: Finance smarter).

- Equity Clock provides historical data and analysis on the S&P 500’s performance in April, noting that historically, this month tends to be positive for equities. Their analysis includes a detailed look at seasonal trends and investor sentiment, which can be useful for understanding market tendencies (Equity Clock).

These resources offer a comprehensive overview of the stock market’s behavior, helping investors make informed decisions based on historical data, current events, and expert analyses.

Your Financial Advisor GPT

Your Financial Advisor is a GPT Dedicated guide for personalized finance advice and operates as a personalized guide in the realm of finance, offering tailored advice and information to users. This GPT specializes in providing relevant, accurate, and up-to-date financial advice. It ensures clarity and simplicity in its explanations, making financial concepts accessible to users regardless of their prior knowledge.

The GPT actively engages users with interactive tools, Q&A sessions, and personalized insights, enhancing their understanding and decision-making in financial matters. It customizes responses and advice according to each user’s specific financial situation and goals. Ethical considerations are paramount; the GPT avoids misleading or harmful financial advice. It also stays vigilant for technical issues, ensuring accurate data usage and optimal performance of its browsing and calculation abilities. Your Financial Advisor is committed to being a reliable and educational resource in finance, adapting to the unique needs of each user.

If you need any further assistance, feel free to ask.