Shanghai Stock Exchange: A Major Player in China’s Capital Market

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

The Shanghai Stock Exchange (SSE) stands as one of the largest and most influential securities exchanges globally. Situated in Shanghai, China, the SSE has played a pivotal role in the development and growth of the country’s capital market. Since its establishment in 1990, it has provided a regulated platform for trading various financial instruments, including stocks, bonds, and funds.

History and Significance

The SSE emerged during China’s economic reforms, aiming to establish a more efficient market system. Its inception marked a significant milestone in China’s financial landscape, as it introduced a formal stock exchange and provided opportunities for domestic and international investors to participate in the country’s economic growth. Over the years, the SSE has evolved into a vital platform for capital raising, investment, and risk management.

Dual-Currency Listing System

The SSE operates under a dual-currency listing system, enabling transactions in both Chinese yuan (CNY) and foreign currencies, such as the U.S. dollar (USD). This approach facilitates international investors’ involvement in the Chinese market and promotes the integration of China’s financial system with global markets. The dual-currency listing system broadens the reach and accessibility of the SSE, enhancing liquidity and attracting foreign investment.

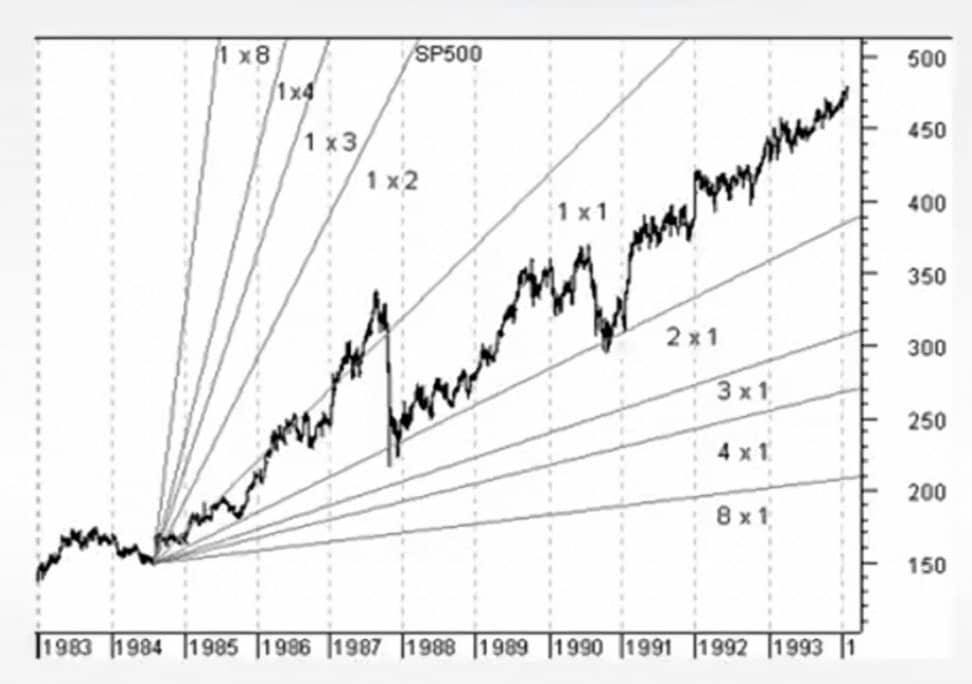

Shanghai Composite Index (SCI)

The Shanghai Stock Exchange is closely associated with the Shanghai Composite Index (SCI), which serves as a barometer of the market’s overall performance. The SCI represents a broad range of companies listed on the SSE and provides investors with insights into the Chinese stock market’s trends and movements. The index includes both A-shares (denominated in yuan and primarily accessible to domestic investors) and B-shares (denominated in foreign currencies and accessible to foreign investors).

Regulations and Foreign Investment

It’s important to note that China’s capital market has specific regulations and restrictions, particularly regarding foreign investment. While the SSE has made efforts to open up to international investors, there are still limitations and requirements that foreign entities must navigate. Qualified Foreign Institutional Investors (QFIIs) and Renminbi Qualified Foreign Institutional Investors (RQFIIs) are among the programs that allow certain foreign investors to access China’s capital market.

Other Stock Exchanges in China

In addition to the Shanghai Stock Exchange, China boasts other significant stock exchanges, including the Shenzhen Stock Exchange (SZSE) and the Hong Kong Stock Exchange (HKEX). The SZSE, located in Shenzhen, focuses on technology and growth-oriented companies, while the HKEX, situated in Hong Kong, serves as an international financial hub connecting China with global investors. These exchanges collectively contribute to the vibrancy and dynamism of China’s capital market.

Conclusion

The Shanghai Stock Exchange stands as a prominent symbol of China’s economic progress and its integration into the global financial system. With its dual-currency listing system, the SSE has attracted significant domestic and foreign investment, providing a platform for companies to raise capital and investors to participate in China’s growth story. As China’s capital market continues to evolve, the SSE, alongside other exchanges, plays a critical role in shaping the country’s financial landscape and driving economic development.

Thank you for reading and sharing!

Source OpenAI’s ChatGPT Language Model and DALLE – Images Picsart

Invest in your future & learn

Learn affiliate marketing & build your own website.

Heads up! Make sure you sign up using my referral link to get access to my personal coaching and all features.

👉 Sign Up