Sage Investments: Understanding the Benefits and Risks.

Sage investments are a popular option for those looking to invest in their financial future. They are a type of investment that is designed to provide a steady return over a long period of time, making them an attractive option for those who want to grow their wealth over the long term. However, as with any investment, there are both benefits and risks to consider before making a decision. In this article, we’ll explore what sage investments are, how they work, and the benefits and risks of investing in them.

What are Sage Investments?

Sage investments are a type of investment that are designed to provide a steady return over a long period of time. They are typically made up of a mix of stocks, bonds, and other securities, and are managed by investment professionals who aim to maximize returns while minimizing risk. Sage investments are often used as a part of a long-term investment strategy, as they are generally considered to be a relatively safe investment option.

How Do Sage Investments Work?

Sage investments work by pooling together funds from multiple investors and using those funds to invest in a variety of different assets. The goal is to create a diversified portfolio that is able to weather market fluctuations and generate a steady return over time. The investments are managed by a team of investment professionals who use their expertise to make informed investment decisions and manage risk.

Benefits of Sage Investments

There are several benefits to investing in sage investments. One of the primary benefits is the potential for long-term growth. Because sage investments are designed to provide a steady return over a long period of time, they can be an effective way to grow your wealth over the course of several years or even decades. Additionally, sage investments are often considered to be a relatively safe investment option, as they are designed to minimize risk through diversification and professional management.

Another benefit of sage investments is the convenience they offer. By pooling together funds from multiple investors, sage investments can provide access to a diverse range of assets that might be difficult or expensive to access on your own. Additionally, because the investments are managed by investment professionals, you don’t need to have specialized knowledge or expertise in investing in order to benefit from sage investments.

Risks of Sage Investments

Despite their benefits, sage investments also come with some risks that investors should be aware of. One of the primary risks is the potential for market fluctuations. While sage investments are designed to minimize risk through diversification and professional management, there is still the possibility that the investments will lose value due to changes in the market.

Additionally, because sage investments are managed by investment professionals, there are fees associated with the investments. These fees can eat into your returns and reduce the overall profitability of your investment. It’s important to understand the fees associated with sage investments before making a decision to invest.

Sage investments can be a great option for those looking to grow their wealth over the long term. They offer a number of benefits, including long-term growth potential, professional management, and diversification. However, as with any investment, there are also risks to consider, including market fluctuations and fees. Before investing in sage investments, it's important to carefully consider your financial goals and risk tolerance, and to work with a financial professional to develop a long-term investment strategy that meets your needs.

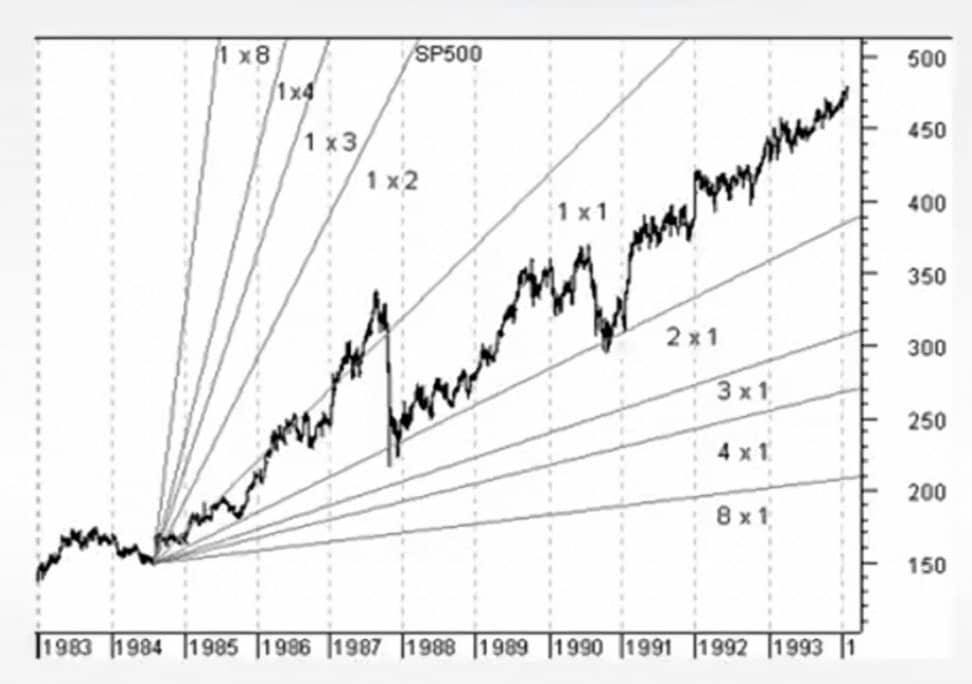

A few examples of Sage investments that have performed well over the past decades

- Vanguard Total Stock Market Index Fund (VTSAX): This fund is designed to track the performance of the overall US stock market, and is made up of thousands of individual stocks across a range of sectors. It has historically provided a steady return of around 7-8% per year, making it a popular option for long-term investors.

- Fidelity Contrafund (FCNTX): This fund invests primarily in large-cap US stocks, and is known for its ability to outperform the market over the long term. It has provided an average annual return of around 12% over the past 20 years.

- T. Rowe Price Blue Chip Growth Fund (TRBCX): This fund focuses on investing in large-cap growth stocks, and has a track record of providing strong returns over the long term. It has provided an average annual return of around 14% over the past 20 years.

- iShares Core U.S. Aggregate Bond ETF (AGG): This fund invests in a broad range of US bonds, and is designed to provide a steady return with relatively low risk. It has provided an average annual return of around 4% over the past 10 years.

- SPDR Gold Shares ETF (GLD): This fund invests in physical gold bullion, and is designed to provide a hedge against inflation and market volatility. It has provided an average annual return of around 6% over the past 10 years.

- Vanguard Total Bond Market Index Fund (VBTLX): This fund invests in a broad range of US bonds, including government and corporate bonds. It is designed to provide a steady return with relatively low risk, and has provided an average annual return of around 4% over the past 10 years.

- T. Rowe Price Equity Income Fund (PRFDX): This fund invests in a mix of large-cap value stocks and high-yield bonds, and is designed to provide both income and growth over the long term. It has provided an average annual return of around 10% over the past 20 years.

- Vanguard Dividend Growth Fund (VDIGX): This fund invests primarily in large-cap US stocks with a history of increasing their dividends over time. It is designed to provide a steady stream of income over the long term, and has provided an average annual return of around 12% over the past 10 years.

- iShares Global REIT ETF (REET): This fund invests in real estate investment trusts (REITs) from around the world, and is designed to provide both income and growth over the long term. It has provided an average annual return of around 8% over the past 5 years.

- PIMCO Total Return Fund (PTTRX): This fund invests primarily in US government and corporate bonds, and is known for its ability to navigate changing interest rate environments. It has provided an average annual return of around 4% over the past 10 years.

It's important to note that past performance is not a guarantee of future results, and that all investments come with some level of risk. It's always a good idea to do your own research and consult with a financial professional before making any investment decisions.

Table summarizing the pros and cons of the Sage investments mentioned

| Investment | Pros | Cons |

| Vanguard Total Stock Market Index Fund (VTSAX) | Long-term growth potential, diversification | Market fluctuations, potential for high fees |

| Fidelity Contrafund (FCNTX) | Outperformance potential, long-term growth | Risk of underperforming the market, potential for high fees |

| T. Rowe Price Blue Chip Growth Fund (TRBCX) | Strong returns, focus on growth stocks | Higher risk due to focus on growth stocks, potential for high fees |

| iShares Core U.S. Aggregate Bond ETF (AGG) | Steady return, low risk | Low potential for growth |

| SPDR Gold Shares ETF (GLD) | Hedge against inflation and market volatility | No underlying cash flows, fluctuations in gold prices |

| Vanguard Total Bond Market Index Fund (VBTLX) | Steady return, low risk | Low potential for growth |

| T. Rowe Price Equity Income Fund (PRFDX) | Income and growth potential | Higher risk due to mix of value stocks and high-yield bonds |

| Vanguard Dividend Growth Fund (VDIGX) | Steady stream of income, focus on dividend growth | Higher risk due to focus on dividend-paying stocks |

| iShares Global REIT ETF (REET) | Income and growth potential, diversification | Risk of underperforming the market, fluctuations in real estate prices |

| PIMCO Total Return Fund (PTTRX) | Potential to navigate changing interest rate environments | Potential for high fees |

Do your own research and consult with a financial professional before making any investment decisions, as the benefits and risks of each investment can vary depending on your individual financial situation and goals.

Shop tip

Sage Investments: Benefits and Risks On Amazon

Video

Are alterntive Investments safe

And your sage investments?

Invest in your future & learn

Learn affiliate marketing & build your own website.

Heads up! Make sure you sign up using my referral link to get access to my personal coaching and all features.

👉 Sign Up

Source OpenAI’s ChatGPT Language Model and DALLE – Images Picsart