Amazon.com Inc. (AMZN): Dominant Market Position and Diversification Across Multiple Industries, but Potential for Regulatory Scrutiny

Amazon.com Inc. (AMZN) is one of the world’s largest e-commerce and cloud computing companies, and is widely recognized as a leader in the tech industry. Founded in 1994, Amazon has grown rapidly over the years, expanding into new markets and industries through a combination of strategic acquisitions and internal development.

One of the key strengths of AMZN is its dominant market position in e-commerce. The company has established itself as the go-to destination for online shopping, offering a wide range of products and services at competitive prices. Additionally, AMZN has successfully diversified its business, expanding into areas such as cloud computing, streaming media, and advertising.

Another strength of AMZN is its focus on innovation. The company invests heavily in research and development, and has been able to stay ahead of its competitors by continually introducing new and improved products and services. AMZN’s innovations have helped to drive growth in the e-commerce, cloud computing, and advertising markets, and have positioned the company for continued success in the future.

Despite its strengths, there are also some potential risks associated with investing in AMZN. One risk is the potential for regulatory scrutiny. AMZN has faced increased regulatory attention in recent years, particularly around antitrust concerns related to its dominance in the e-commerce market. Any regulatory action against AMZN could have a negative impact on the company’s financial performance.

Another risk is the potential for increased competition in the e-commerce and cloud computing markets. While AMZN has a dominant market position in these areas, other companies such as Walmart and Microsoft are actively working to compete with AMZN’s offerings.

AMZN is a dominant player in the tech industry with a strong market position and a focus on innovation. Its diversification across multiple industries has positioned the company for continued growth, but there are also potential risks associated with regulatory scrutiny and increased competition. As with any investment, it’s important to do your own research and consult with a financial professional before making any investment decisions.

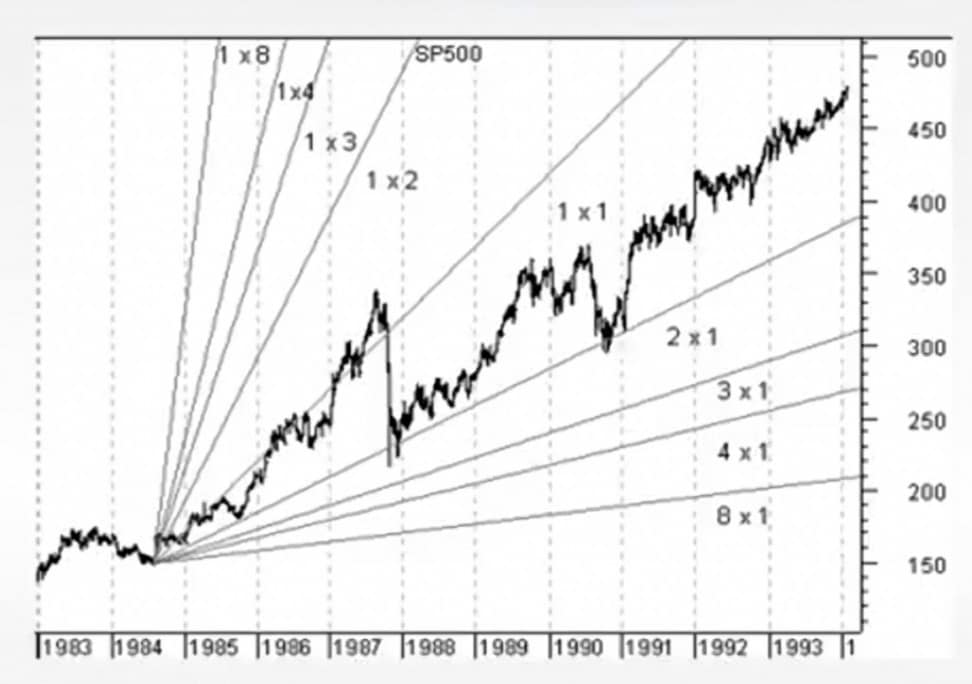

Table summarizing the pros and cons of investing in Amazon.com Inc. (AMZN)

| Pros | Cons |

| Dominant market position in e-commerce | Potential for regulatory scrutiny |

| Diversification across multiple industries | Potential for increased competition |

| Strong focus on innovation and R&D | Valuation concerns due to high P/E ratio |

It’s important to note that this table only highlights some of the key pros and cons of investing in AMZN, and that the benefits and risks of each investment can vary depending on your individual financial situation and goals. It’s always a good idea to do your own research and consult with a financial professional before making any investment decisions.

Some general information on future expectations and competitors for Amazon.com Inc. (AMZN)

Looking to the future, AMZN is expected to continue its strong performance due to its dominant market position in e-commerce and diversification across multiple industries. The company is also well-positioned to benefit from the growing trend towards e-commerce and cloud computing.

However, there are also potential challenges and competitors for AMZN. One challenge is the potential for regulatory scrutiny, as the tech industry as a whole has faced increased regulatory attention in recent years. Additionally, AMZN faces competition from other e-commerce companies such as Walmart and Target, as well as from other cloud computing providers such as Microsoft and Google.

Another potential challenge for AMZN is its high valuation, which could make it vulnerable to market corrections or downturns. However, the company’s strong financial position and diversification across multiple industries could help to mitigate this risk.

In addition to established competitors, AMZN may also face competition from emerging technologies and startups in areas such as artificial intelligence, blockchain, and augmented reality. While these technologies are still in the early stages of development, they could potentially disrupt the e-commerce and cloud computing industries in the future.

Despite these challenges and competitors, AMZN is well-positioned to continue its strong performance due to its dominant market position and focus on innovation. However, as with any investment, it’s important to do your own research and consult with a financial professional before making any investment decisions.

Shop tip

Investing in Amazon on Amazon

A great asset!

Invest in your future & learn

Learn affiliate marketing & build your own website.

Heads up! Make sure you sign up using my referral link to get access to my personal coaching and all features.

👉 Sign Up

Source OpenAI’s ChatGPT Language Model and DALLE – Images Picsart